In my introduction post to this series, How to Live a More Old-Fashioned Life, I explained the heart of the matter. We need to find more balance in our lives. Doing so means pulling back from the internet a bit and learning to live a more old-fashioned life. So to continue on from there, in this post I am sharing old-fashioned money management ideas.

This article isn’t about how to be more thrifty, that will come later. This is about the nuts and bolts of how to handle money; the basics of old-fashioned money management. This means the principles and wise ways previous generations handled their money.

“In managing her finances in a scientific way, the homemaker will, first, keep account of her expenditures; she will pay cash, as cash is the cheapest, and bills which are allowed to hang develop errors which cannot be rectified with the ease that they can be detected in a weekly bill; [the homemaker] she will check up all bills carefully, to avoid error: she will keep receipts in accurate form, and all important receipts for a year at least; she will live on less than her income, and save, in partnership with her husband, for a common object; [the homemaker] she will not incur debt, or buy “on time,” where she would have to pay an inflated value, and where it is morally weakening to use an article for which she has not paid.”

Frederick, C. (1913). Household Finances. In The New Housekeeping; Efficiency Studies in Home Management (pp. 125-126). essay, Doubleday, Page & Company.

Good money management is vital to homemaking

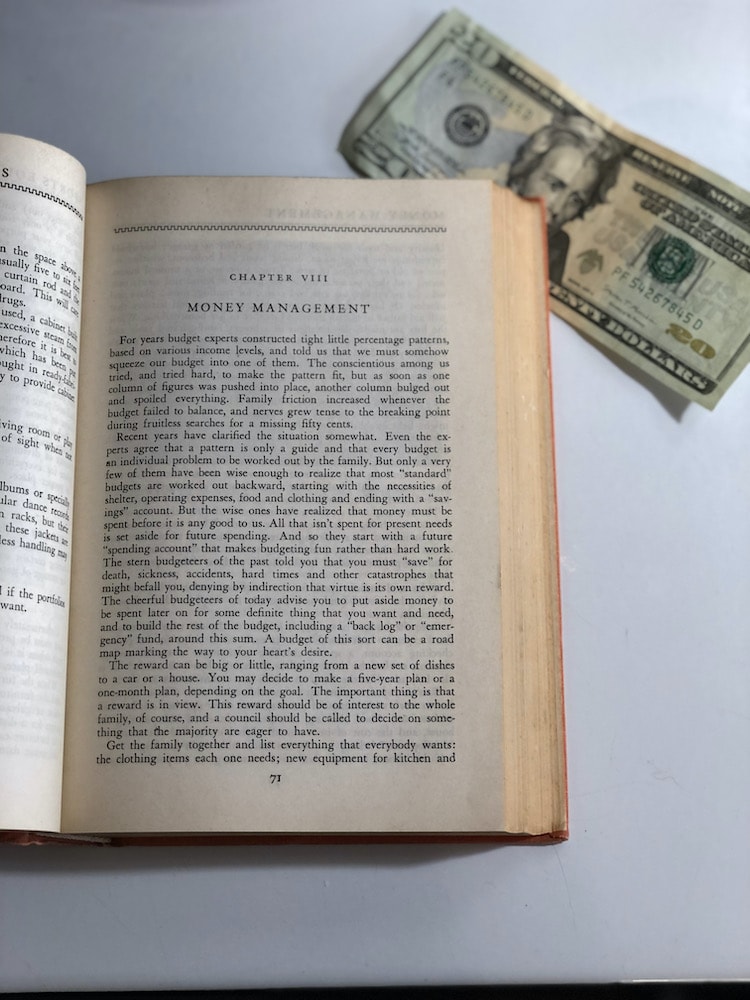

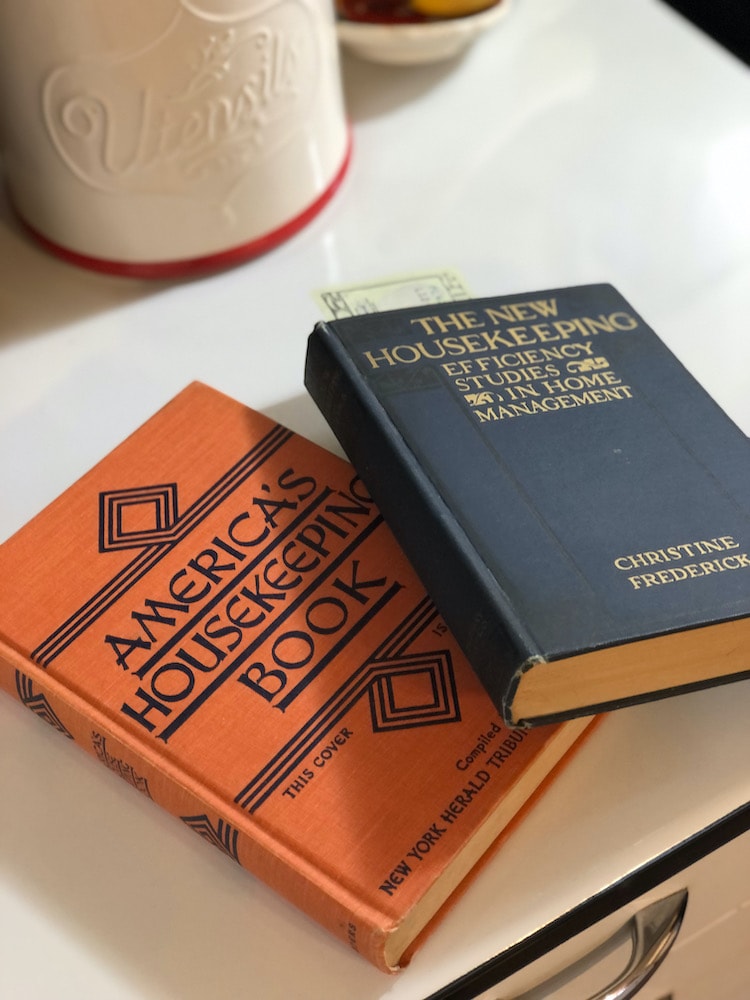

Whether we like it or not, good money management is a vital part of homemaking. So vital in fact, that both vintage homemaking books, my 1913 copy of The New Housekeeping; Efficiency Studies in Home Management and my 1941 copy of America’s Housekeeping Book each give a whole chapter to the topic of Household Finances and Money Management. .

Although I have a copy of each of these books on my bookshelf, you can click the link on the book titles to access the complete digital copies for free through Google Books & Open Library.org.

“This question of the management of the household finances is the most vital in the running of the home, and is often deeply concerned in the happy relation of husband and wife. This is the one point in which the husband and wife must ‘pull together.’ No really successful management of the home can result if both husband and wife do not equally and mutually agree as to the distribution of their finances. The homemaker must understand definitely what the income is; the income-earner must know definitely how that income is disbursed, and both of them must have the same standards in view, and the same ideal or motive toward which to save.”

Frederick, C. (1913). Household Finances. In The New Housekeeping; Efficiency Studies in Home Management (pp. 116). essay, Doubleday, Page & Company.

The spirit of old-fashioned money management

In researching for this topic, I decided to use these source documents from two completely different historic time periods. This way I could get a feel for what old-fashioned money management really looked like. But I am also aware that some current day issues are not written about back then, like the influence of technology. So I pressed the underlying ideas from these books against the problems and issues of today. Doing this, I created some new solutions that still had the spirit of old-fashioned money management.

I also couldn’t write this without talking about Dave Ramsey (I am not an affiliate). I have been a follower of Dave Ramsey’s financial plan for over 5 years now. And although I may not quote him directly, I must give him credit for the ideas that have shaped the way I view money. Dave’s point of view and what he says often, is that he “coaches every day folks on God’s and Grandma’s ways of handling money”.

I’m a firm believer that we cannot try to recreate the past, but instead look for the wisdom from it. So, although we can’t use every money management idea from the past, we can look at the overall picture. We can try to understand and incorporate those pieces of age-old wisdom into our own lives today.

Also, I must state that I am not a financial expert or authority on this subject. I am a lover of history, homemaking and old-fashioned living. I can only say what I read and do in my own life.

Please do your own research when it comes to financial advice.

Below, I have written out 9 ways we can use old-fashioned money management ideas in our own lives today.

Old-Fashioned Money Management

Use a budget

Write out a budget with your spouse every month so you can plan where your money is going to go.

“Who keeps the budget? Some authorities say the man of the house should accept this responsibility. Others believe that the homemaker, who spends 85 cents out of every dollar, is the logical person to record expenditures. We believe that the choice should be made by the family, and that the one who takes most naturally to figures and records should keep the budget.”

Home Institute, N. Y. H. T. (1941). Chapter VIII: Money Management. In America’s Housekeeping Book (1947 Edition, PP. 78). Essay, C. Scribner’s Sons.

This quote shows that budgeting is both a task that needs to be done for money management, but also that the choice of who records the budget be up to each individual family and their needs.

The way my husband & I handle writing a budget is that we plan the month together. By talking and deciding each category’s allotted amount together, each spouse has equal input. This way, the person recording the budget (in this case, me, the homemaker) is just working out the plan originally set in place together. Then, when the homemaker carries out those plans, they are just recording in the budget that the money allotted has been spent.

For example, at the beginning of the month, a couple decides together with equal input that $500 is allotted to the grocery budget. The homemaker then divides that number by 4 weeks a month, making it $125 a week to spend on the weekly grocery trip. Then the homemaker records in the budget after each of those trips to the grocery store that the money has now been spent. Therefore, the homemaker carries out the plans that were made together with their spouse and kept the record of the expenditures because they were the one that spent the money.

If you are looking for how to specifically start writing a budget, Dave Ramsey’s article How to Create a Zero-Based Budget will help get you started.

Use cash instead of credit cards

“‘Consumer credit’ and ‘pay out of income’ are words that we hear with ever-increasing frequency. Buyers are urged, sometimes under high-pressure tactics, to have all the things they need and want through the magic of ‘a small down payment’ and ‘easy monthly payments’ thereafter.”

“Remove yourself from the source of high-pressure talk long enough to do a little clear thinking and figuring.”

HOME INSTITUTE, N. Y. H. T. (1941). CHAPTER VIII: MONEY MANAGEMENT. IN AMERICA’S HOUSEKEEPING BOOK (1947 EDITION, PP. 80). ESSAY, C. SCRIBNER’S SONS.

Using cash instead of credit cards may sound outdated now to some of you. The thought of carry around coins and bills, instead of the convenience of swiping a card may be weird. Along with being a hallmark of old-fashioned money management and thinking, there are lots of benefits of using cash instead of credit cards. One is that you spend less. According to a study done in 2008 by the Journal of Experimental Psychology: Applied,

“Given the proliferation of a variety of payment modes in the marketplace, the primary objective of this research was to examine differences in spending decisions and behavior as a function of payment mode. This research explicitly distinguishes among pay- ment modes that differ in terms of payment coupling and in terms of payment form and argues that relative to paying by cash, other payment modes are less transparent as one does not feel the outflow of money as vividly. The vividness of the money outflow leads to a higher pain of paying with cash than with other less transparent payment modes. In other words, the pain of paying is somewhat dulled by less transparent payment modes such as a gift certificate or credit card thus increasing the likelihood of spending when using these payment modes.”

Raghubir, P., & Srivastava, J. (2008). Monopoly money: The Effect of Payment Coupling and Form on Spending Behavior. Apa.org. Retrieved January 2, 2022, from https://www.apa.org/pubs/journals/releases/xap143213.pdf

Pg. 223. Originally published Journal of Experimental Psychology: Applied 2008, Vol. 14, No. 3, 213–225.

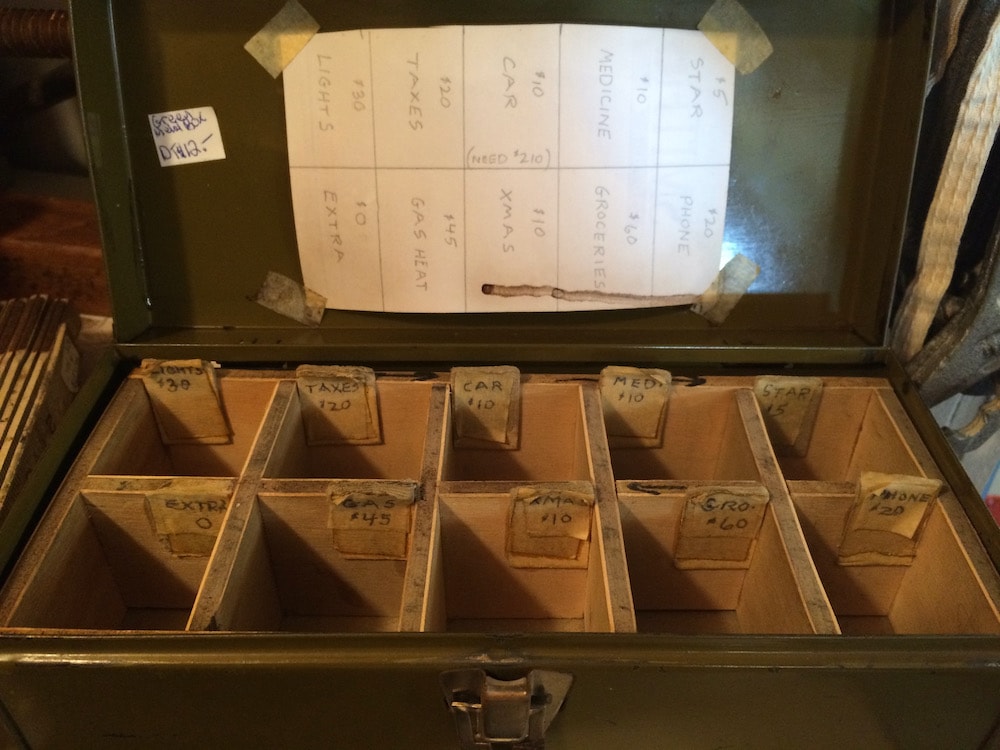

The envelope system

The photo to the right is of a vintage cash box I found at an antique store. This is one way of how someone budgeted their money into categories. Another way to do this is through an envelope system.

The way an envelope system works is that at the beginning of the month, you put in each envelope the cash amount you have budgeted for that category. And once you have spent through that money, that’s it. It’s gone until the next month. You can’t buy any more from that category. This may sound slightly harsh, but it works.

This may work for you if you have trouble keeping track of what you’ve spent and inputting that information in your budget. Also, if you tend to over spend in only a couple of categories, you can choose to do this system for just those categories.

Using this method, there’s only one transaction to be budgeted; the amount you withdrew to put into that envelope.

For more information about using an envelope system, check out this article, Dave Ramsey’s Envelope System Explained.

Save for a rainy day

“Some families whose incomes boast a small surplus, or who can ‘manage’ to reserve a few dollars over and above expenses, like to build up a separate bank account as an emergency reserve or “balance wheel.’ This account should never be drawn upon for minor emergencies or to make up deficits. Authorities recommend that $500-$1,000 be built up and maintained in this account.”

HOME INSTITUTE, N. Y. H. T. (1941). CHAPTER VIII: MONEY MANAGEMENT. IN AMERICA’S HOUSEKEEPING BOOK (1947 EDITION, PP. 75). ESSAY, C. SCRIBNER’S SONS.

Remember, milk cost about $0.52 – $0.63 a gallon back then… so $500 – $1,000 is a lot of money now but was a heck of a lot of money back then. According to the US Bureau of Labor Statistics, today that equivalent amount would be $9,856.31 – $19,712.62. This is a good estimate for saving a current day 3-6 month emergency fund.

Save up for purchases for old-fashioned money management

“The surplus, after both [spouses] have supplied their common needs, should be placed in some form of savings or “sinking” fund toward the proverbial rainy day, and for use when the ordinary salary is not sufficient, as at times when there is a heavy drain of buying clothes for winter.”

Frederick, C. (1913). Household Finances. In The New Housekeeping; Efficiency Studies in Home Management (pp. 122). essay, Doubleday, Page & Company.

Save up for purchases above and beyond the emergency fund. The job of the emergency fund is to get you through when an emergency happens. Car maintenance is not an emergency; every one knows that basic maintenance like oil changes are necessary. Car completely breaking-down very unexpectedly though, may be an emergency. Getting a new makeup pallet is not an emergency.

Save up for things you know are coming up on the horizon ahead and for items you want to buy. Sure, you may not be able to buy the item immediately. But when you do finally get it, it will be that much better because it’s completely yours and you don’t have a payment on it.

Delete your saved credit cards from your internet browser and websites

If you apply the same concepts already written about in the article, it’s pretty plain to see this would have been in those books, had they had the technology back then.

By deleting your saved credit cards from your internet browser and websites, it takes away that layer of “ease”. Instead of buying something with “one tap”, you literally have to get up from your seat. You have to go get your wallet, get out the card and manually input it for any transaction. By creating this situation, you are more likely to only buy what you really need, instead of a right-in-the-moment purchase.

Get the real paper bill & pay by check in the mail for old-fashioned money management

Some ideas I have listed are things you may have done in your own life time and may be something worth going back to.

This may seem quite outdated for some of ya’ll… but up until about 2 years ago, I paid all my bills with checks through the mail. Yeah, I did. I was very resistant to changing to online payments.

Even though physical, paper bills and money may seem the opposite direction of where our society is going, that doesn’t mean that it’s the best direction for your life.

By going back to a real bill & pay by check, this may allow some people to have more control of their finances instead of “auto-pay” drafts. This is because you know how much you are being charged. You have to look at the physical bill every month. Plus, you know when there is a discrepancy, real quick.

This also requires at least one appointed time every month when you sit at the kitchen table and take care of the bills. This is what people did for a long time.

Sure, you can still look at an e-bill statement. And maybe you’re forgetful, so auto-pay really helps you a ton. That’s fine, I’ve never said technology is always a bad thing. If it works for you, then skip this one.

Balance your checkbook

What an old-fashioned sounding phrase. A checkbook? But yes, instead, this now may look more like balancing your checking account instead of checkbook. But reconciling your income and expenses is a must. This way no transactions are missed and you are made aware of any errors or fraudulent charges. This article here by Dave Ramsey; How to Balance Your Checking Account can guide you through the process if you haven’t done it before.

Get your physical paychecks with the pay stub attached, instead of direct-deposit

I’ve always thought that if more people looked at their paystub, the way things work in this world would be very different.

I did this since my first job at 16, up until only a couple years ago. I was definitely way late to direct-deposits. No surprise there, since I’m writing an article about old-fashioned money management, ha! Even remember writing out those deposit slips at the bank, and going to the teller because it wasn’t that long ago.

This one is not for the faint of heart though. It takes some dedication these days.

Firstly, it may not even be available at your workplace anymore. Then, getting the physical check. Depositing it or cashing it at the bank. If depositing it, potentially receiving the money later then if it was direct deposit. Your bank may even charge you monthly maintenance fee’s if you don’t have a direct-deposits.

But I knew I had to put this one on the list because it’s the way things were for a very long time. It’s easy to forget the way things are now is very new. It all depends on what matters to you.

Don’t get sucked into buying the latest gadgets

This is so important. If you take one thing away from this article about old-fashioned money management it’s this:

Live within your budget and don’t get sucked into living above your means.

What I’m going to say may sound crazy. But, I think our society has enabled a mindset that as long as I can afford the monthly payment, then it’s okay to buy.

Aside from a home purchase, I’m of the mindset, that if I can’t buy it completely in cash, then it wasn’t meant to be.

I’ll tell ya what, everything I own, I own.

And sure that thing I own may not be anything fancy. Maybe it’s the 1997 vehicle I paid cash for over 2 years ago. The car has current inspection and still lives in my drive-way today. Some people would not be willing to drive an old car though. But I am.

It’s a pretty comforting and freeing thought that I’ll never lay awake at night worried about how I’m going to make that payment for something I bought month’s ago.

Maybe I’m just too old-fashioned.

Living a more old-fashioned life is a mind-set shift. It’s learning to be content with what you have and “making-do”. Hate to break it to you, but living this way, you will never catch up with the Jones’s. But I see that as a good thing. Then you are truly free to make your own decisions instead of letting society make those purchasing decisions for you.

Just a reminder, I am not a financial expert or authority on this subject. I am a lover of history, homemaking and old-fashioned living. I can only share what I read and do in my own life. Please do your own research.

Wrapping Up

So to wrap up this post, I hope it inspires you to research more on the subject of old-fashioned money management.

Be sure to check out the other posts I’ve written in this series below.

And keep an eye out for the next installment of the series, where I tackle another area of life.

Check out the rest of my A More Old-Fashioned Life Series

How to Live a More Old-Fashioned Life

Felicia

I’m really enjoying this series 🙂

Mountain Mama

I’m so glad – thank you so much!! 🙂

Sadie

These are great tips! I really love the vintage cash box you found! What a cool way to help you stay on track. Thanks for sharing!

Mountain Mama

Thank you! It was such an awesome find! 🙂

Laura

These are some great ideas! Thanks for sharing!

Mountain Mama

Thank you very much, Laura! 🙂

Jill

Great info!! Thanks for sharing!

Mountain Mama

Thank you, Jill! 🙂

Suani

I too was very late to online bill payments. With the new direct deposit, my husband and I both will log on and make sure we check the pay stubs. Thank you for putting this research together, I’m always drawn to learning how things used to be done in the olden days.

Mountain Mama

That’s a great point – people should definitely double-check their paystubs with what is deposited online! Thank you so much 🙂

Dee

This was a great post. We have followed Dave’s principles and are out of debt except the mortgage (in Colorado, whew!) I wondered how you deleted or stopped shopping online and only pay cash. I used to when we lived in Steubenville. Everything was within 10 min. Here, a small mountain town we don’t have much. It’s an hour to Target or Dollar Tree. I have tried to delete Amazon more times then I can count, and I am totally open to ideas of how others reduce or eliminate online shopping. This seems to always be the budget breaker now.

Mountain Mama

Hi Dee, I apologize again for the late reply to this comment as well. That’s so great to hear that you are out of debt except for the mortgage! That is a big congratulations! As to your question; I wish I could say I have COMPLETELY stopped and that I ONLY use cash, but I agree, it is extremely tough. Where I live it’s a hike to the store as well. I unfortunately still use Amazon for certain items through the internet and shipped, especially specialty items that are hard to find in the stores near me. But I do try and do large grocery trips, where I go out to the store and stock up for like 2 weeks of items, at places where I have the ability to use cash. I say ability because even some places have “card only” lines and stuff like that, which makes it really challenging. But what I would say, is do what you can. If there is a category that you consistently go over in because of online shopping, maybe make that one category a cash envelope.

I wish you all the best! And thank you so much for your comment.

-Stephanie